Life Update - July 2020

- Blake

- Aug 1, 2020

- 4 min read

July was a pretty jam-packed month for us. The weather is too good not to spend as much time outside as possible. Every weekend we try to get out and do something, whether it's visiting some friends or getting away by ourselves. The first weekend of the month just so happened to fall on July 4th and that coincided with our good friend Tom's 30th birthday. Woop woop!

To help celebrate, a few of Tom's close friends and family booked a few cabins at a local camp a few clicks north of town right on the water. It was a fantastic weekend filled with fishing, garden games, boating, jello shots, good food and great company.

Tom's in-laws have a camper and boat set up permanently at camp, so we had the pleasure of fishing and cruising around for a few hours. Our daughter Addi got to see the mystical mermaid and our son Callum was even lucky enough to help drive a boat! They were both so excited. Yes, he's wearing a pink adult life jacket. It's all we had. Better than nothing!

I mentioned last month that we purchased some camping gear and accessories and we finally had our chance to use them!

I'll be honest, we weren't super confident of our camping abilities since Allanah and I hadn't really camped since we were young. Actually the last time I went camping with my dad and a few family friends was when I was 8, and it ended with me visiting the hospital with a burnt hand because I chose to nearly sit on hot tin that had just been pulled from the fire... Anyway, here's to better experiences nowadays eh?

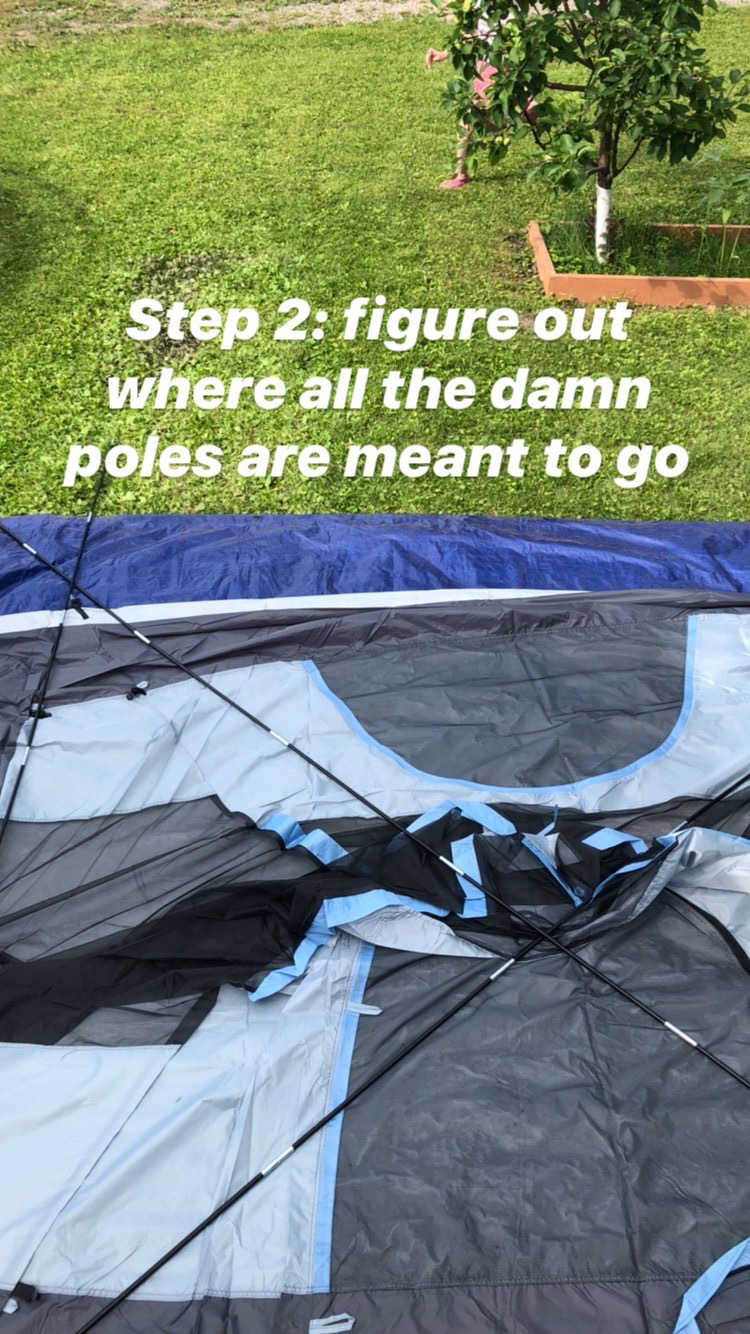

So to make sure we wouldn't look like fools when we actually went camping the next weekend, we set up the new tent and all the accessories in the backyard. This was our test run. The kids really enjoyed it too. Here's a few snaps of us putting up the tent for the first time, documented on Insta of course!

Safe to say it was a success and a bit easier than what we thought. I tell you what though, our little town is a noisy one at night! We had hooligans yelling up the street, speeding cars down the highway, and the sound of a bloody train what felt like every 10 minutes. Pretty broken sleep that night.

A few weeks later, a few lads from work and I traveled an hour to zip away on a houseboat for 3 days. What a weekend! The boat slept 7 (which was great, there were 7 of us) and it was just what us blokes needed for our adventure. We traveled the lake during the day and parked up on a beach during the night. Safe to say there was a lot of banter that weekend, a few fish, and a lot of beer! Wouldn't have it any other way though. It took me about 4 days to fully recover from the trip but totally worth it.

Now, onto the finance portion of the blog.

SAVINGS UPDATE

In July we hit our savings goal and saved 38% of our take home pay. It was the same percentage as June, but June shows as red? Yes, in June we purchased camping supplies, a new vacuum, and a carpet cleaner.

We hadn't factored that into our budget. In July, we planned for the increase in travel and other categories so that's why we were able to meet the target we had set. You have to adjust your budget to be relevant each month. It's important to be flexible.

Just because you set a budget at the start of the year, doesn't mean you can't adjust it each month. You SHOULD! It's your finances and it needs to reflect your real world situation.

We gained a few percent closer to our goal for the year, and we're still on track to reach it by the end of the year.

NET WORTH SNAPSHOT

July was the first true month that we clocked over $300k for our net worth. We are now sitting at about $302K. Previously we had documented a $304K net worth back in June but that was without updating my Superannuation figure or depreciating our car value. So that's why I say this is the first time we "truly" hit the 300 club.

It's about a $15K increase from last month and a $70k increase since November 2019. July's increase was driven mainly from investment contribution and those investments also increasing. A small bit can be attributed to an increase in cash savings too.

Not much of a change in the Assets/Liabilities snapshots. Our RRSP portion increased by a percent, and our cash savings portion went up a fraction. No big swingers this month.

All in all July was a great month. It's important to include fun activities in your monthly budgets and not be a total prude. Happiness comes from time spent with family and friends, surrounding yourself in positivity. Don't forget to make time for these things and spend a bit of money when it's needed.

Also guys, we're always keen to get your feedback and input on what you want to see. Please let us know what you want to hear more about and we'll do our best to give you the best content we can.

Blake - FIRE with a family

Comments